Rental Income

|

Use this job aid to complete the Real Estate Owned Information and Rental Income in the HUB. |

Real Estate Owned (REO) Information

|

Step |

Action |

|||||||||

|

1 |

Go to Full Application -> REO Information. |

|||||||||

|

2 |

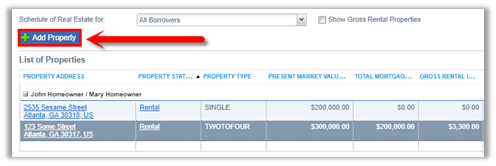

· Ensure all properties are listed in the Schedule of Real Estate Owned. · Click Add Property to enter REO that is not listed. |

|||||||||

|

3 |

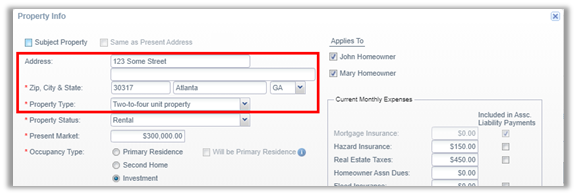

Enter the property Address and Property Type. |

|||||||||

|

4 |

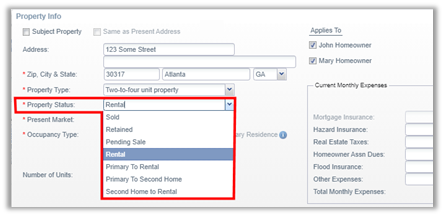

Select the Property Status from dropdown.

Note: If the Current Primary Residence is converting to an Investment property, enter as per the table below to have the HUB and AUS consider the conversion calculations.

|

|||||||||

|

5 |

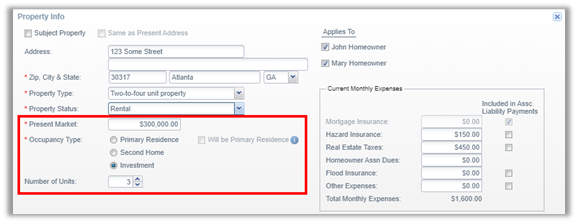

Enter or update as necessary: · Present Market Value · Occupancy Type Will be Primary Residence checkbox – Use only if the Borrower does not currently occupy the subject property and is refinancing the subject as the primary residence. · Number of Units – Must be entered to complete rental income information on multi-unit rental properties. |

|||||||||

|

6 |

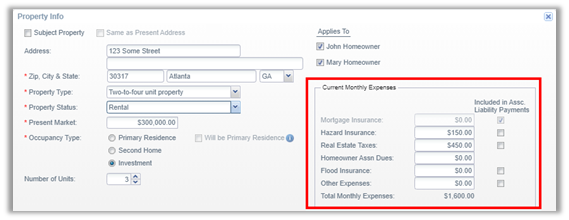

Enter or update the Current Monthly Expenses as applicable. · Place checkmark next to any housing expense already included in mortgage liability aka “Associated Liability”. · Leave unchecked if the housing expenses are NOT included in the liability payment.

|

|||||||||

|

7 |

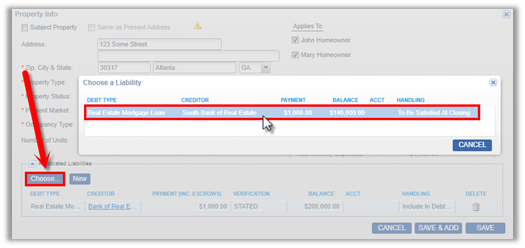

Indicate all Associated Liabilities. · Click Choose to select from existing liabilities. · Click to associate a liability to the property. Note: Click New to enter an associated liability not listed. |

Rental Income

|

Step |

Action |

|

1 |

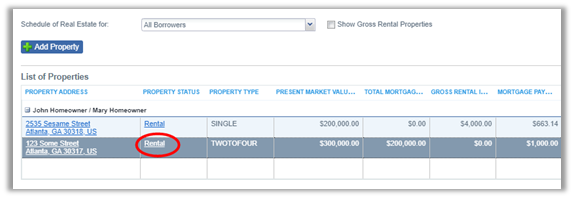

Click the Rental hyperlink under Property Status. |

|

2 |

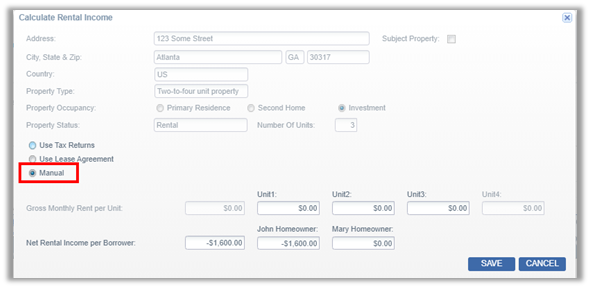

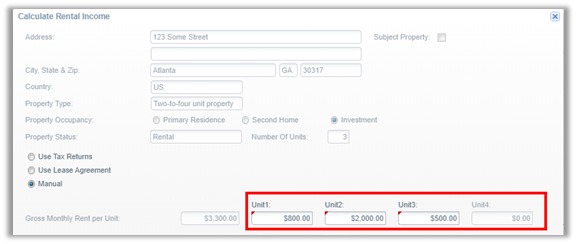

· The Calculate Rental Income screen will open. · Select Manual. Note: The Net Rental Income per Borrower automatically populates the PITIA expense. |

|

3 |

Enter the Gross Monthly Rental Income per unit. Notes: · Unit 1 will be grayed out for owner occupied rental properties. · Fields for individual units will open based on # of units entered on the Property Info pop up in REO Information. |

|

4 |

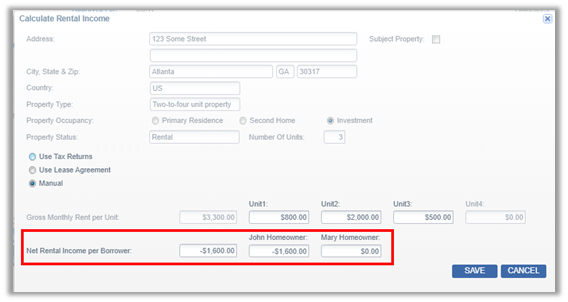

Net Rental Income per Borrower – The HUB will automatically populate the PITIA expense. If the Borrower is NOT using rental income to qualify, total PITIA must remain or be re-entered as negative value for Net Rental Income. Update the Net Rental Income per Borrower (if required). · The amount entered as Net Rental Income per Borrower will automatically be applied to the primary Borrower (This is the value passed to AUS). - The total amount may be allocated between multiple borrowers (if applicable). · If Net Rental Income is a Loss, enter as negative value. · Click Save.

|

|

5 |

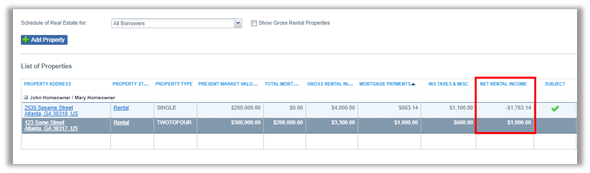

Net Rental Income for all properties will display on the REO Information screen. |

|

Results |

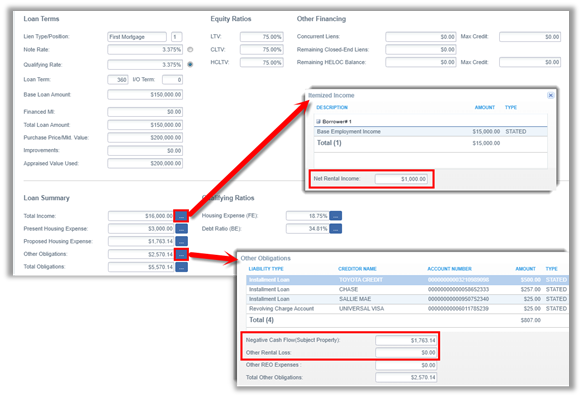

Positive and negative cash flow will display on the Ratios screen. |

Comments

0 comments

Please sign in to leave a comment.