The HUB and the URLA

|

This document explains updates to the Uniform Residential Loan Application (URLA) and the corresponding changes in the HUB.

Click here for questions and support. |

Section 1: Borrower Information

|

This section asks about the borrower’s personal information and their income from employment and other sources, such as retirement, that they want considered to qualify for the loan. |

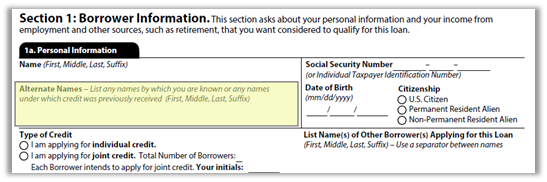

1a. Personal Information

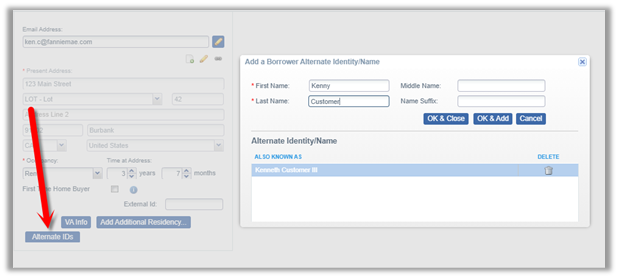

Alternate Names

|

The Personal Information section captures Alternate Names under which the Borrower previously received credit.

|

|

To review/edit Alternate Names: · Go to the Full Application->Borrowers screen. · Click the Alternate IDs button.

|

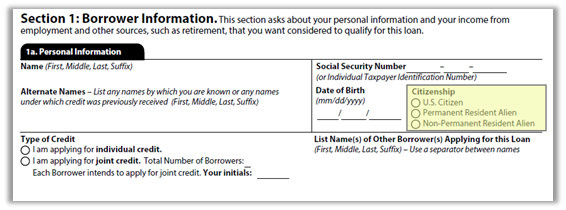

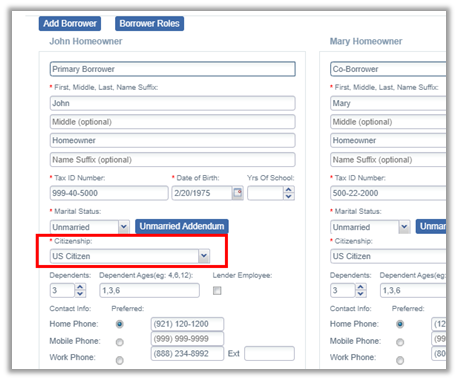

Citizenship

|

Citizenship is now in the Personal Information section.

|

|

To review/edit Citizenship in the HUB: · Go to the Full Application->Borrowers screen. |

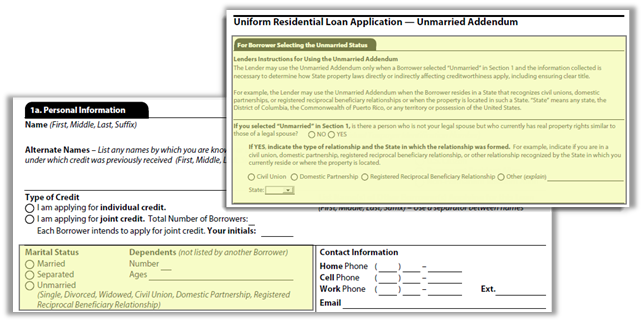

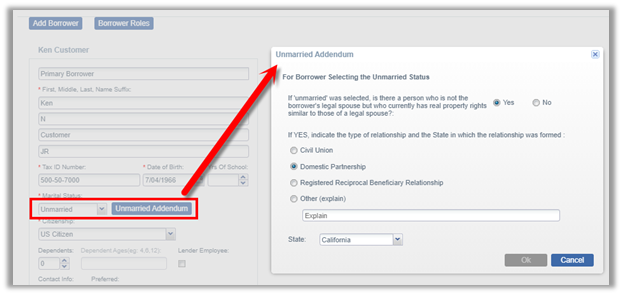

Marital Status

|

Use the Unmarried Addendum only when a Borrower selects Unmarried in Section 1 and the information collected is necessary to determine how State property laws directly or indirectly affecting creditworthiness apply, including ensuring clear title. |

|

To review/edit the Unmarried Addendum: · Go to the Full Application->Borrowers screen. · Click the Unmarried Addendum button. |

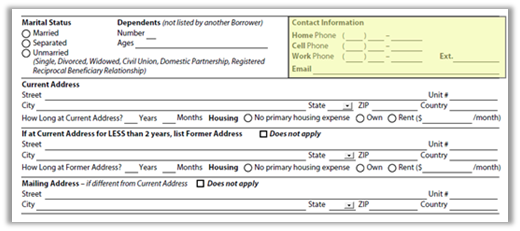

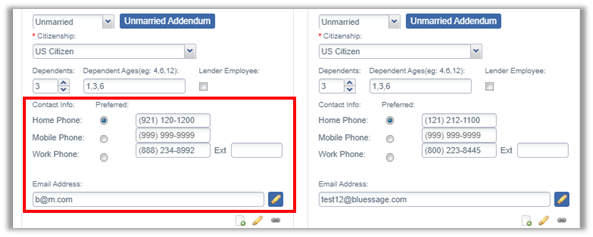

Contact Info

|

Contact Information for the Borrower now includes fields for cell phone, direct work phone, and email. |

|

Contact Information is on the Full Application->Borrowers screen. |

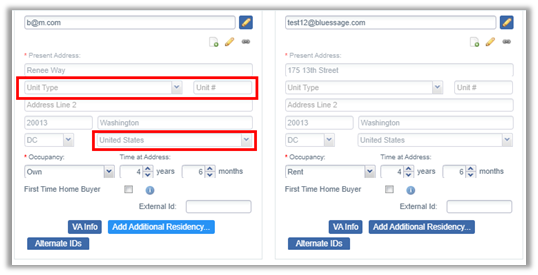

Current Address

|

The Borrower’s Current Address section now has fields for Unit Type, Unit #, and Country. In addition, this section indicates ownership status and the monthly rent payment amount. |

|

Review/edit Current Address information on the Full Application->Borrowers screen. Notes: · Current Address Rent amount is entered on the Full Application->Housing Expenses screen. · For Borrower’s living rent free, select Living Rent Free for Occupancy dropdown. |

Former and/or Mailing Address

|

To enter a Former and/or Mailing Address: · Go to the Full Application->Borrower screen. · Click the Add Additional Residency button. · Select Former Address or Mailing Address and enter the required information. |

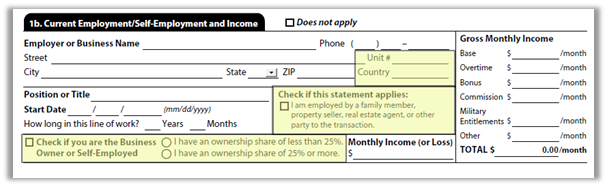

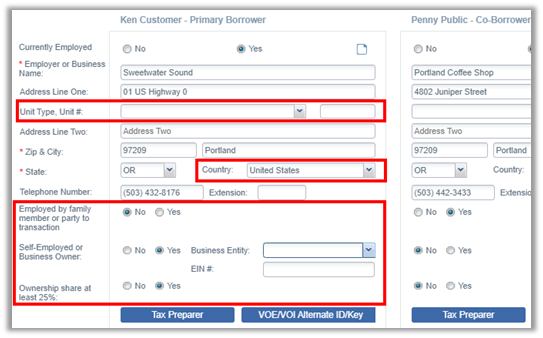

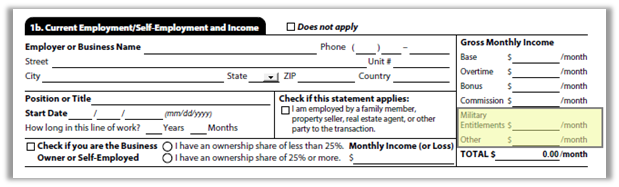

1b. Current Employment/Self-Employment and Income

|

Employment and Income sections have been combined into one section and capture information regarding transactional relationships and business ownership.

|

|

Current Employment and Income information is also combined in the HUB on the Full Application->Employment/Income screen. New Fields: · Unit # and Country of Employer or Business. · Indicator for Employed by family member or party to the transaction. · Indicator for Self-Employed or Business Owner. · Indicator of Ownership share at least 25%.

|

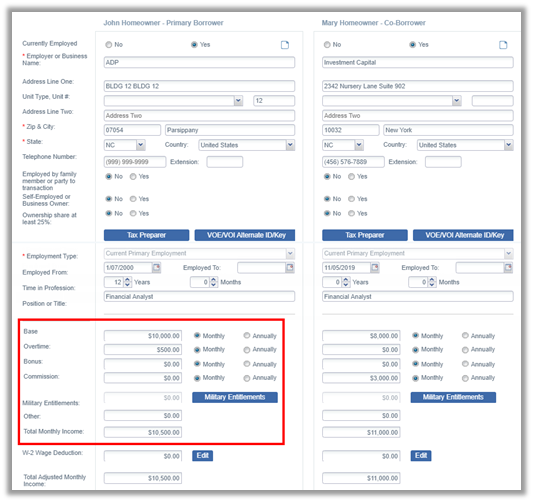

Gross Monthly Income

|

Gross Monthly Income is now to the right of all income sources on the new URLA.

|

|

Gross Monthly Income for Current Employment is captured below the Employer information.

Note: Monthly Income (or Loss) as Business Owner or Self-Employed is populated in the HUB with the Total Monthly Income field. |

Military Entitlements & Other

|

The Employment/Self-Employment and Income sections now have separate fields for Military Entitlements and for Other income from each Employer or Business.

|

|

To enter Military Entitlements as part of the Borrower’s income: · Go to the Full Application->Employment/Income screen. · Click the Military Entitlements button. · Click the Add Military Income button. · Enter the Income Type, Amount, and Non-Taxable indicator. · Repeat for each type of Military Income.

Note: Review/edit Income from Other Sources (Section 1e) on the Full Application->Income screen. |

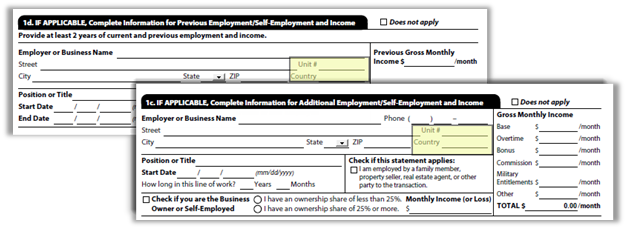

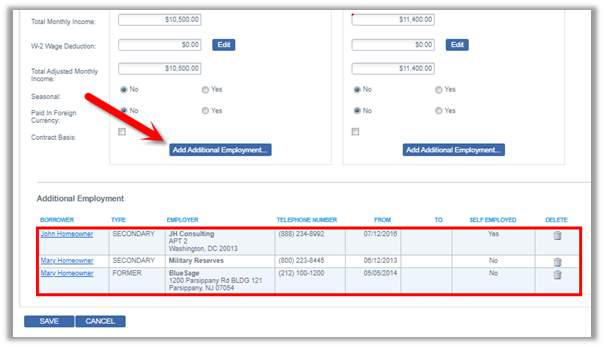

1c & 1d. Additional & Previous Employment/Self-Employment and Income

|

The Additional and/or Previous Employment/Self-Employment, and Income sections have been updated with the new address fields.

|

|

Former and Secondary employment are listed as Additional Employment at the bottom of the Employment/Income screen. · Click the Add Additional Employment button when applicable. · Click the Borrower hyperlink to edit an existing entry.

|

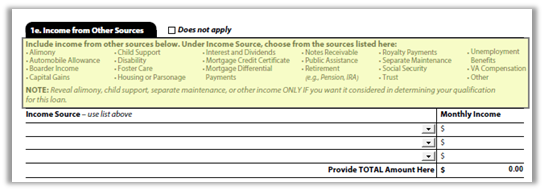

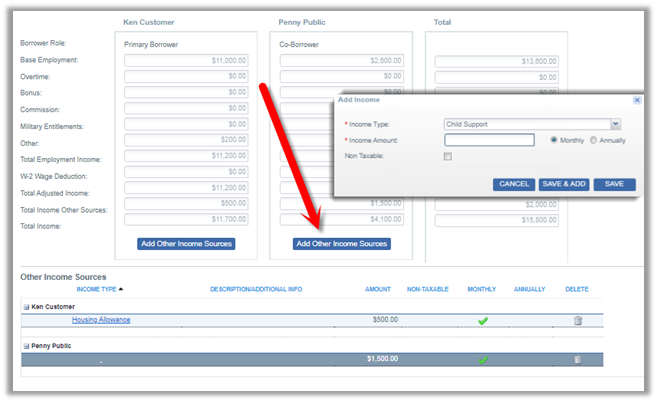

1e. Income from Other Sources

|

Income from Other Sources now has a more comprehensive list of Income Sources from which to choose.

|

|

To review/edit Income from Other Sources: · Go to the Full Application->Income screen. · Click the Add Other Income Sources button for the corresponding Borrower.

|

Section 2: Financial Information – Assets and Liabilities

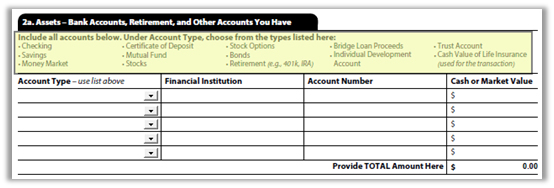

2a. Assets – Bank Accounts, Retirement, and Other Accounts You Have

|

Assets are broken into 2 categories – Depository Assets and Other Assets. Depository assets (checking, savings, etc) are listed in section 2a.

|

|

The Financial Account type selections have been updated to match the new application. To add a Financial Account Asset: · Go to the Full Application->Assets screen. · Click the Add Asset button.

Note: Gifts and Grants are entered as Assets in the HUB but are in Section 4d on the new URLA. |

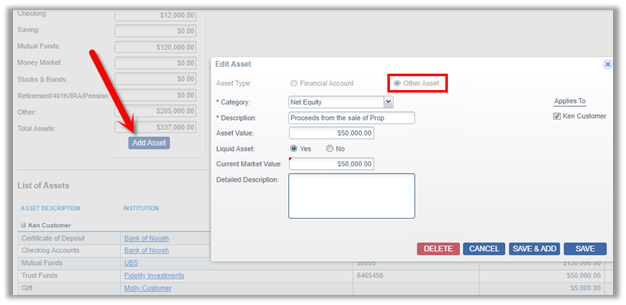

2b. Other Assets and Credits You Have

Other Assets

|

The Other Assets and Credits section is for Borrower assets that are not account related.

Note: Credits are added on the new Qualifying the Borrower screen (see next section). |

|

The HUB has been updated with the new Other Asset types. To add an Other Asset: · Go to the Full Application->Assets screen. · Click the Add Asset button. · Select the Other Asset radial button.

· Asset Value -Value required for AUS findings. · Liquid Asset – Selection is not required, does not pass to AUS, nor does it affect the AUS findings. · Current Market Value - Value is required as it is the figure that is printed on the 1003. Note: Enter Proceeds from Sale of Property as Net Equity. |

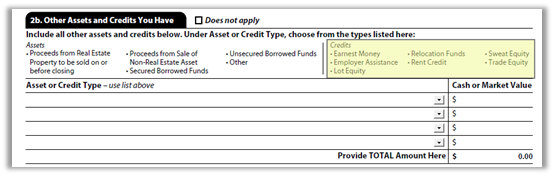

Other Credits

|

Borrower Credits (Earnest Money, Relocation Funds, etc) are also listed in Section 2b.

|

|

In the HUB, Credits are added on the Qualifying the Borrower screen (previously known as the Details of Transaction). To add an Other Credit: · Go to the Full Application->Qualifying the Borrower screen. · Click the Other Credits button. · Click the Add button and select the Other Credit Type from the Dropdown.

Note: Enter cash deposit on sales contract as Earnest Money. |

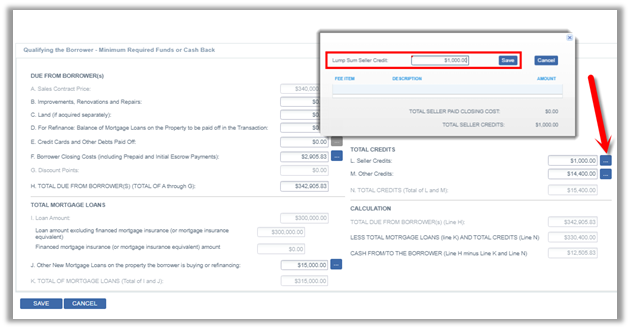

Seller Credits

|

Seller Credits are added on the Qualifying the Borrower screen (previously known as the Details of Transaction). To review/edit a Seller Credit: · Go to the Full Application->Qualifying the Borrower screen. · Click the Seller Credits button. Note: Seller credits may also be reviewed/edited from the Processing->Fees & Closing Costs screen. |

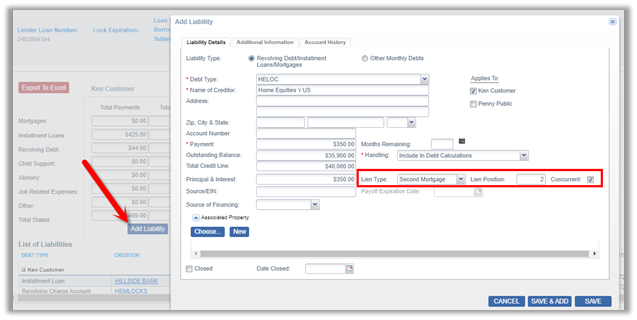

2c. Liabilities – Credit Cards, Other Debts, and Leases that You Owe

|

The Liabilities section lists all liabilities (except real estate) including liabilities with deferred payments. |

|

To review/edit a Liability: · Go to the Full Application->Liabilities screen. · Click the Creditor hyperlink.

|

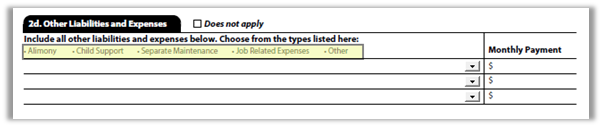

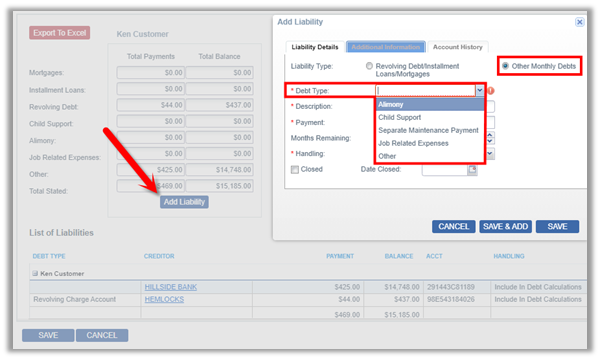

2d. Other Liabilities and Expenses

|

This section is for other liabilities and expenses (Alimony, Child Support, etc.) that are not connected with a financial institution or company.

|

|

Other Liabilities and Expenses are listed in the HUB on the Liabilities screen. To enter Other Liabilities and Expenses: · Go to the Full Application-> Liabilities screen. · Click the Add Liability button. · Select the Other Monthly Debts radial button.

|

Section 3: Financial Information – Real Estate

|

The Real Estate section was modified to help correlate debt to the property owed by the Borrower. Real Estate credit liabilities now display with their associated properties. |

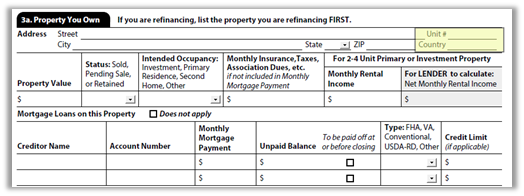

3a. Property You Own

|

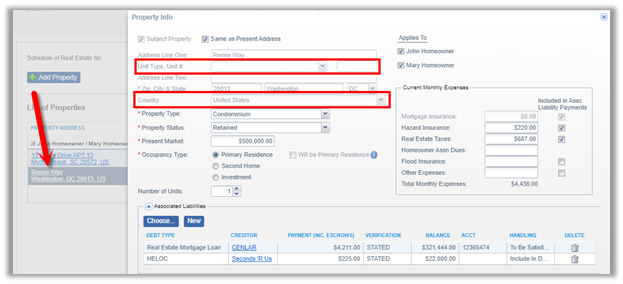

Unit # and Country fields have been added to the Property You Own section. |

|

To review/edit properties owned: · Go to the Full Application->REO Information screen. · Click the address hyperlink. To add a property: · Go to the Full Application->REO Information screen. · Click .

Note: Additional properties are listed in sections 3b & 3c of the new URLA and are added to the HUB with the Add Property button. |

Section 4: Loan and Property Information

4a. Loan and Property Information

|

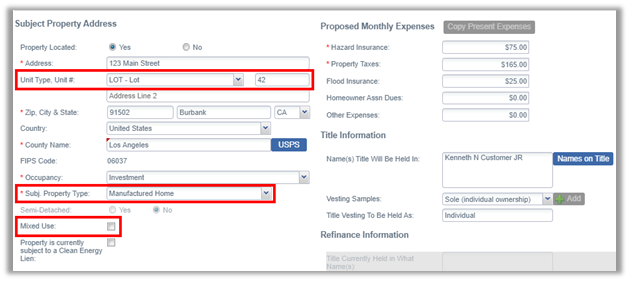

The new URLA has indicators for FHA Secondary Residence, Mixed-Use Property, and Manufactured Home. |

|

To review/edit the purpose and property information: · Go to the Full Application->Purpose & Property screen. New Fields: · Unit Type and Unit # · Manufactured Home · Mixed Use

|

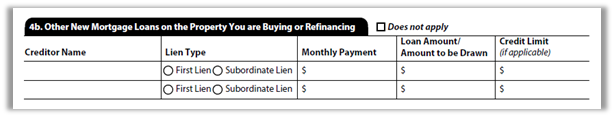

4b. Other New Mortgage Loans on the Property You are Buying or Refinancing

|

This section identifies any additional loans or liens that the applicant is obtaining against the subject property.

|

|

To add a new Concurrent mortgage loan on the subject property: · Go to the Full Application->Liabilities screen. · Click the Add Liability button.

|

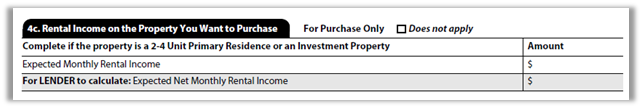

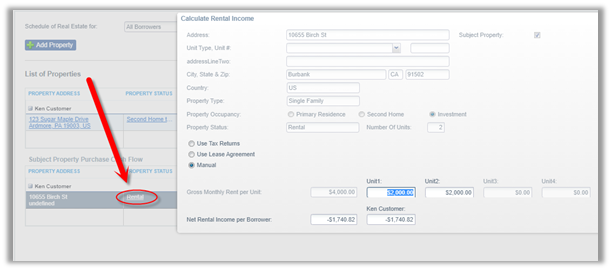

4c. Rental Income on the Property You Want to Purchase

|

This section identifies the amount of expected rental income from the subject property. |

|

To view/edit the Subject Property Cash Flow: · Go to the Full Application->REO Information screen. · Click the Rental hyperlink under Property Status.

|

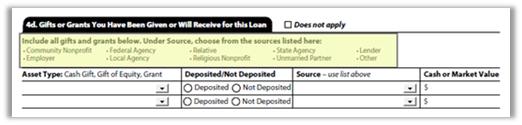

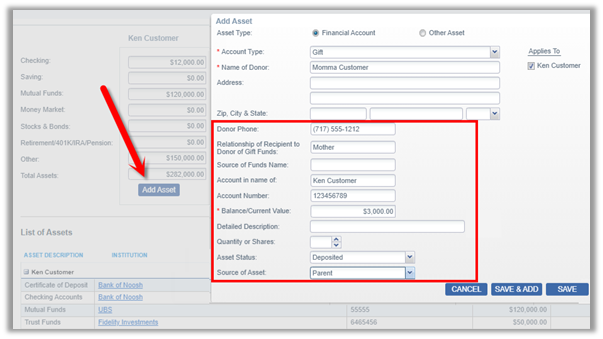

4d. Gifts or Grants You Have Been Given or Will Receive for this Loan

|

This section lists gifts or grants the Borrower has or will receive for the loan, if the funds have been deposited, and the source of the gift or grant. |

|

Gifts or Grants are added as Assets in the HUB: · Go to the Full Application->Asset screen. · Click the Add Asset button. · Select Account Type from the dropdown. · Asset Status Deposited – Indicates that the gift amount is accounted for in a depository account. Not Deposited – Adds the amount of the gift to the Available Assets. · Source of Asset – AUS findings will be based on the dropdown selection. An error or ineligible findings will be received if field is blank.

New Fields for Gifts: · Donor Phone · Relationship of Recipient to Donor of Gift Funds · Source of Funds Name · Account in the Name of · Account Number · Quantity or Shares |

Section 5: Declarations

|

Please pay close attention to the Declarations which are now in two sections – About this Property and Your Money for this Loan and About Your Finances. In addition, the Borrower now has the ability to provide additional explanations. The Declarations in the HUB have been updated to reflect these changes. |

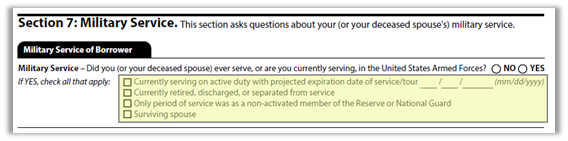

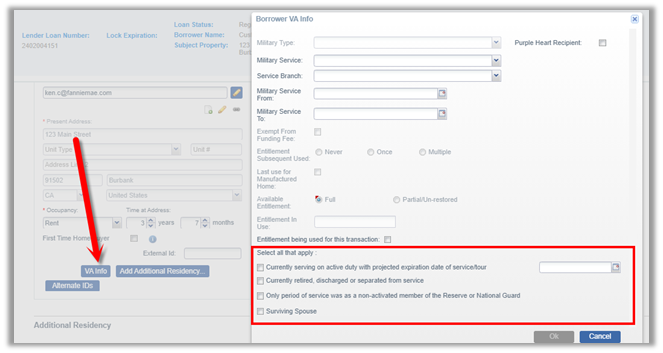

Section 7: Military Service

|

Additional questions regarding Military Service have been added to the new URLA. |

|

To review/edit the Military Service information: · Go to the Full Application->Borrowers screen. · Click the VA Info button.

|

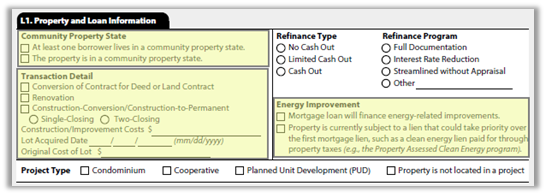

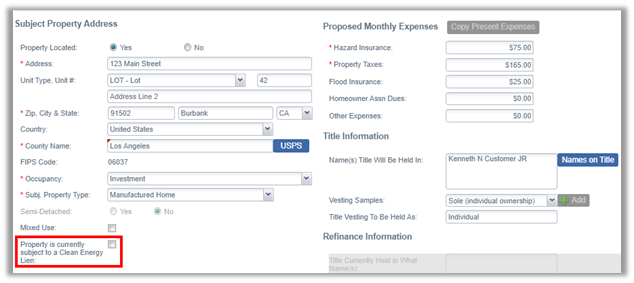

Lender Loan Information

L1. Property and Loan Information

|

The Lender Property and Loan section captures additional information including Community Property State, Transaction Details, and Energy Improvement.

Note: Community Property State and Transaction Detail information populates from the Broker’s 3.4 file. |

|

To review/edit the Clean Energy Indicator: · Go to Full Application->Purpose and Property screen. · Property is currently subject to a Clean Energy Lien - Select when question 5aE on Declarations is YES.

|

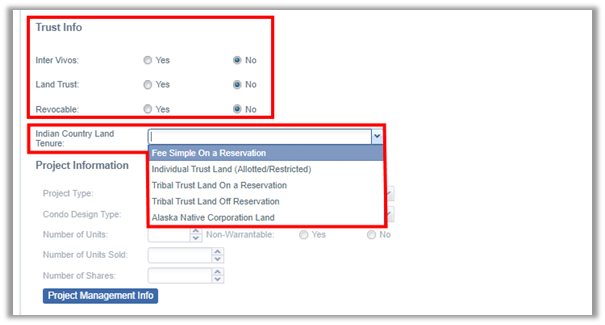

L2. Title Information

|

The Title Information section now has indicators for Trust Information and for Indian Country Land Tenure.

|

|

To review/edit Trust information and Indian Country Land Tenure in the HUB: · Go to the Full Application->Purpose and Property screen. · Scroll to the bottom of the screen.

|

Comments

0 comments

Please sign in to leave a comment.